Advertisement

SKIP ADVERTISEMENT

Supported by

SKIP ADVERTISEMENT

Stocks Set Records and Dollar Soars After Trump Election Win

Joe RennisonEshe NelsonDaisuke Wakabayashi and Danielle Kaye

Joe Rennison and Danielle Kaye reported from New York, Eshe Nelson from London and Daisuke Wakabayashi from Seoul.

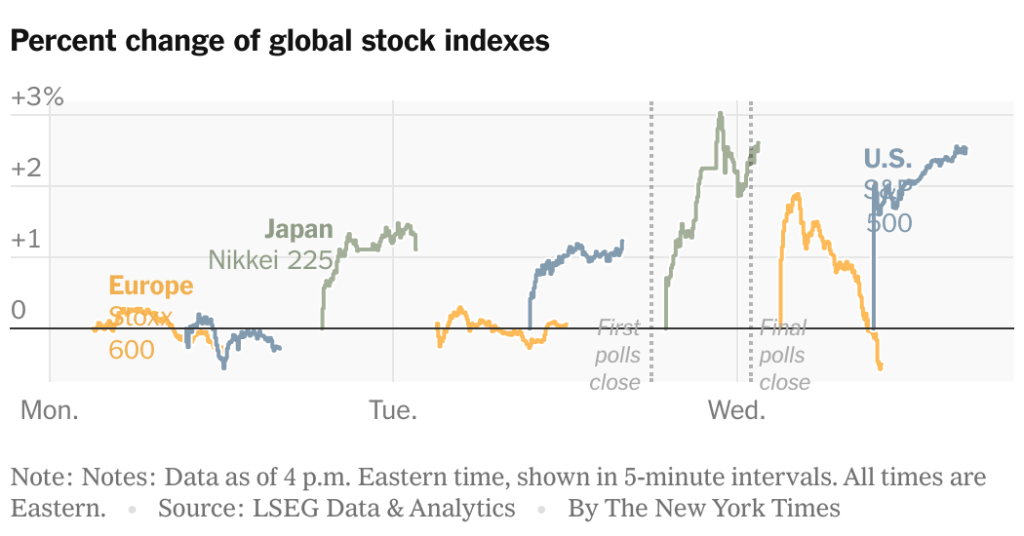

Stocks surged to record highs, the dollar strengthened around the world, and government bond yields soared on Wednesday after a conclusive win by President-elect Donald J. Trump.

In part, the reaction is typical following a presidential election, with a spate of activity as the outcome of the vote becomes clear and puts an end to months of uncertainty. But analysts and investors noted that the reaction looked stronger than just relief, with traders preparing for more government spending, lighter regulation, bigger deficits and accelerating growth under a Trump administration and at least partial Republican control of Congress.

“What we are seeing is a visceral reaction to a surprising outcome given very tight polling,” said Kristina Hooper, chief global market strategist at Invesco. “Markets are reacting positively to a decisive victory.”

U.S. stock markets had risen steadily overnight as the votes were counted and shot higher at the open of trading on Wednesday. The S&P 500 rose 2.5 percent, its biggest one-day gain in roughly two years, while the tech-heavy Nasdaq Composite index moved almost 3 percent higher. The Dow lurched 3.6 percent higher. The Russell 2000, which tracks smaller companies considered to be more sensitive to the fate of the economy, jumped almost 5 percent, its biggest one-day rise in roughly two years as well.

All four indexes notched record highs at the end of the trading day.

Bitcoin rose sharply, also hitting a record. Mr. Trump has promised to end the Biden administration’s regulatory push against cryptocurrency and establish the United States as the “crypto capital of the planet.”

The U.S. dollar rose against the currencies of major trading partners — like the Japanese yen as well as the euro, the Mexican peso and the Chinese renminbi — which were expected to be heavily affected by Mr. Trump’s proposal to substantially raise tariffs. The euro recorded its steepest daily fall against the dollar in more than four years. Major stock indexes around the world slumped.

We are having trouble retrieving the article content.

Please enable JavaScript in your browser settings.

Thank you for your patience while we verify access. If you are in Reader mode please exit and log into your Times account, or subscribe for all of The Times.

Thank you for your patience while we verify access.

Already a subscriber? Log in.

Want all of The Times? Subscribe.

Advertisement

SKIP ADVERTISEMENT

Source: https://www.nytimes.com

More Stories

India Plane Crash: What Investigators Might Examine

Washington Post Cancels Ad From Groups Calling for Trump to Fire Musk

As Trump Attacks D.E.I., Some on the Left Approve