retiring

How to Stop a Late-in-Life Divorce From Ruining Your Retirement

As the number of couples who split after the age of 50 rises, more Americans are looking at a retirement that is drastically different than they had expected.

Supported by

SKIP ADVERTISEMENT

- Published Nov. 17, 2024Updated Nov. 19, 2024

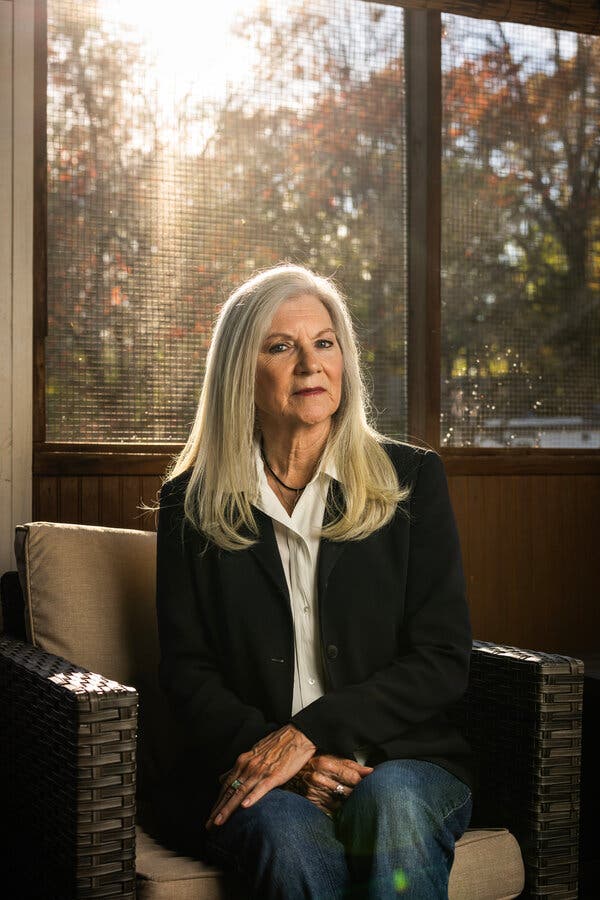

When Margye Solomon decided to end her 33-year marriage last year, she knew her finances would take a big hit.

“I didn’t have enough money to retire before I got divorced, and I have less now,” said Ms. Solomon, who, at 71, still works full time as head of social enterprise and nonprofit partnerships at Ellevate, a global women’s network.

Dividing assets evenly with her ex, a retired lawyer, left her with half as much in savings — but, Ms. Solomon said, “my happiness was worth more to me than the money.”

The 18 months since the split have been an exercise in frugality as Ms. Solomon rebuilds. To cut expenses, she moved from Nutley, N.J., to lower-cost Nashville, where she rents a small apartment in a friend’s home; she bought a used Nissan to get around and watches her spending.

“When you divorce at this age, you can’t be afraid to change your lifestyle,” Ms. Solomon said. “In what could be a 100-year life, I figure I have 20 to 30 years left and I want to make the most of them.”

Ms. Solomon has plenty of company. While divorce rates in the United States have generally been falling, they have doubled for people over age 50 since the 1990s and tripled among those over 65, according to a 2022 study from Bowling Green State University in Ohio. Longer life expectancies and a rise in older women working, which makes divorce more feasible economically, are helping to drive the trend. All told, nearly 40 percent of divorces now involve someone who falls into AARP’s prime demographic.

We are having trouble retrieving the article content.

Please enable JavaScript in your browser settings.

Thank you for your patience while we verify access. If you are in Reader mode please exit and log into your Times account, or subscribe for all of The Times.

Thank you for your patience while we verify access.

Already a subscriber? Log in.

Want all of The Times? Subscribe.

Advertisement

SKIP ADVERTISEMENT

Source: https://www.nytimes.com

More Stories

India Plane Crash: What Investigators Might Examine

Washington Post Cancels Ad From Groups Calling for Trump to Fire Musk

As Trump Attacks D.E.I., Some on the Left Approve