Nvidia closes at record as AI chipmaker’s market cap tops $3.4 trillion

- Nvidia shares hit an all-time high as the chipmaker continues to ride a massive wave of demand for its artificial intelligence chips.

- Companies including Microsoft, Meta, Google and Amazon are purchasing Nvidia’s graphics processing units in massive quantities to build large clusters of computers for AI.

- Nvidia is now worth more than $3.4 trillion.

Nvidia shares closed at a record on Monday as Wall Street gears up for earnings season and updates from all of the chipmaker’s top customers on their planned spending on artificial intelligence infrastructure.

The stock climbed 2.4% to close at $138.07, topping its prior high of $135.58 on June 18. The shares are now up almost 180% for the year and have soared more than nine-fold since the beginning of 2023.

Nvidia, widely viewed as the company selling the picks and shovels for the AI gold rush, has been the biggest beneficiary of the generative AI boom, which started with the public release of OpenAI’s ChatGPT in November 2022. Nvidia’s graphics processing units, or GPUs, are used to create and deploy advanced AI models that power ChatGPT and similar applications.

Companies including Microsoft, Meta, Google and Amazon are purchasing Nvidia GPUs in massive quantities to build increasingly large clusters of computers for their advanced AI work. Those companies are all slated to report quarterly results by the end of October.

Of the billions of dollars the top tech companies are spending annually on their AI buildouts, an outsized amount is going to Nvidia, which controls about 95% of the market for AI training and inference chips, according to analysts at Mizuho.

Nvidia’s revenue has more than doubled in each of the past five quarters, and at least tripled in three of those periods. Growth is expected to modestly slow the rest of the year, with analysts projecting expansion of about 82% to $32.9 billion in the quarter ending in October, according to LSEG.

Nvidia recently said demand for its next-generation AI GPU called Blackwell is “insane” and it expects billions of dollars in revenue from the new product in the fourth quarter.

With a market cap of $3.4 trillion, Nvidia is the second-most valuable publicly traded U.S. company, behind Apple at about $3.55 trillion.

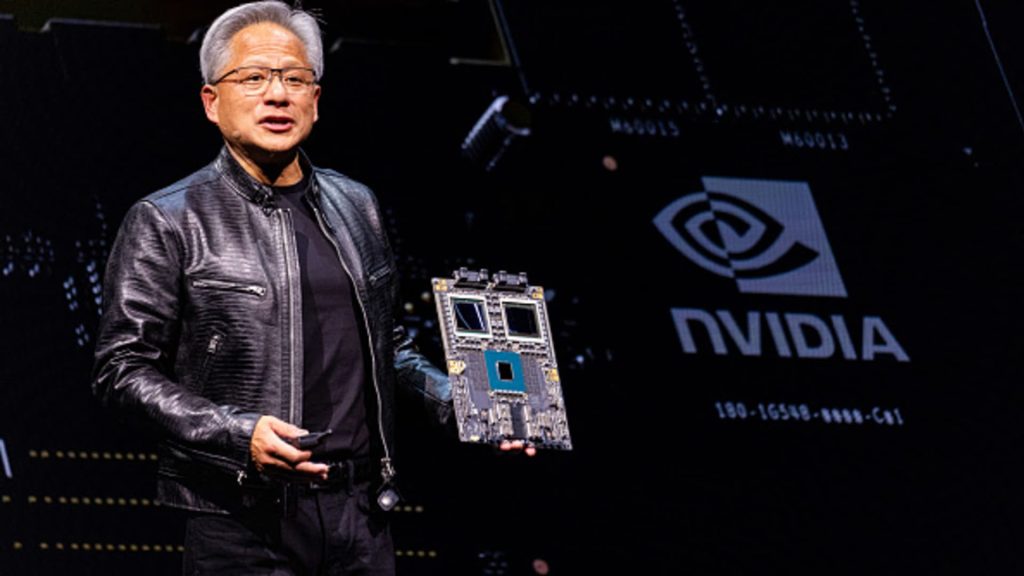

WATCH: Nvidia CEO Jensen Huang on Squawk Box

More In AI Effect

Source: https://www.cnbc.com

More Stories

Trump’s crypto coin goes on sale with Election Day just three weeks out

Nvidia-backed CoreWeave gets $650 million credit line from top Wall Street banks

Cerebras IPO has ‘too much hair’ as AI chipmaker tries to sell Wall Street on Nvidia alternative