Advertisement

SKIP ADVERTISEMENT

Supported by

SKIP ADVERTISEMENT

Weak Economy Prompts European Central Bank to Cut Rates Again

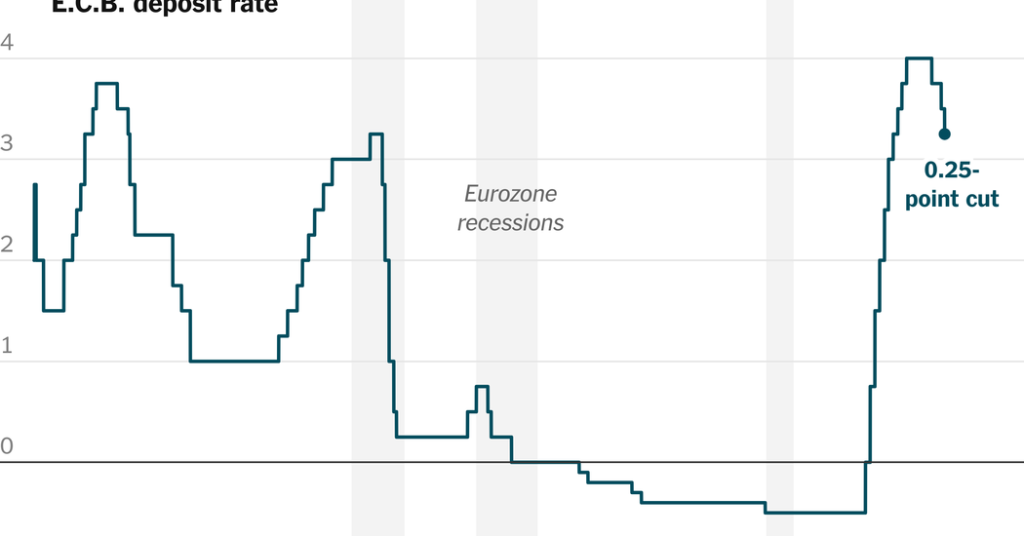

Policymakers who set interest rates for the 20 countries that use the euro have lowered rates in back-to-back meetings for the first time since 2011.

Eshe Nelson

The European Central Bank cut interest rates on Thursday for the third time in about four months, as inflation in the eurozone has cooled faster than expected and economic growth has been sluggish.

Policymakers who set interest rates for the 20 countries that use the euro lowered their key rate by a quarter point, to 3.25 percent. Thursday’s decision came just five weeks after a cut at the bank’s previous meeting, and on a day that a report showed the eurozone’s inflation rate slowing to 1.7 percent in September, falling below the bank’s 2 percent target for the first time in more than three years.

“The disinflationary process is well on track,” Christine Lagarde, the president of the central bank, said at a news conference in Ljubljana, Slovenia.

The rate move was also influenced by weaker-than-expected economic data in the past few weeks. Whether it was the inflation data or surveys of economic activity, “it is the same story,” she said: “It’s all heading in the same direction — downwards.”

After years of trying to force inflation down with high interest rates, central bankers around the world are walking a tightrope as they consider how quickly to cut interest rates. Lowering rates too fast could reignite simmering inflationary pressures, but keeping rates too high for too long risks slowing the economy substantially and inflation becoming too weak.

In recent weeks, policymakers have suggested that rate cuts could be more aggressive as inflation has slowed significantly and economic growth has been lackluster. Last month, the U.S. Federal Reserve cut rates by a half-point, paving the way for quicker or bigger rate cuts in Europe, analysts said. On Wednesday, traders increased their bets that the Bank of England would pick up the pace of its rate cuts after data showed inflation in Britain fell to 1.7 percent in September, below the bank’s 2 percent target.

We are having trouble retrieving the article content.

Please enable JavaScript in your browser settings.

Thank you for your patience while we verify access. If you are in Reader mode please exit and log into your Times account, or subscribe for all of The Times.

Thank you for your patience while we verify access.

Already a subscriber? Log in.

Want all of The Times? Subscribe.

Advertisement

SKIP ADVERTISEMENT

Source: https://www.nytimes.com

More Stories

Washington Post Cancels Ad From Groups Calling for Trump to Fire Musk

As Trump Attacks D.E.I., Some on the Left Approve

One Response to Trump’s Tariffs: Trade That Excludes the U.S.