Microsoft, BlackRock form group to raise $100 billion to invest in AI data centers and power

- The Global Artificial Intelligence Infrastructure Investment Partnership is initially looking to raise $30 billion for new and existing data centers.

- The fundraising, which could total $100 billion, will also be used to invest in the energy infrastructure needed to power AI workloads.

- Microsoft CEO Satya Nadella said the initiative brings “together financial and industry leaders to build the infrastructure of the future and power it in a sustainable way.”

Microsoft and BlackRock are part of a group of companies collaborating to pull together up to $100 billion to develop data centers for artificial intelligence and the energy infrastructure to power them.

The companies are part of the Global Artificial Intelligence Infrastructure Investment Partnership, or GAIIP, which was announced in a press release on Tuesday. The other participants are Global Infrastructure Partners, or GIP, an infrastructure investor that is being acquired by BlackRock, and MGX, a tech investor in the United Arab Emirates.

“We are committed to ensuring AI helps advance innovation and drives growth across every sector of the economy,” said Microsoft CEO Satya Nadella, in a statement. He said the initiative brings “together financial and industry leaders to build the infrastructure of the future and power it in a sustainable way.”

The group aims to assemble $30 billion of initial capital, with a future goal of bringing in up to $100 billion, including from debt financing.

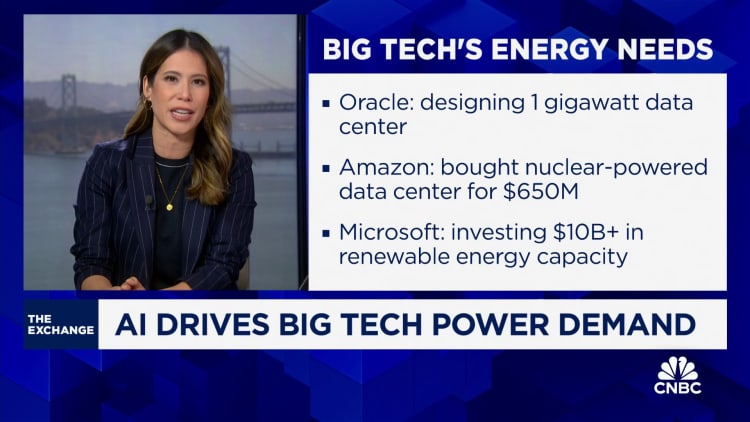

Tech companies have been racing to build data centers full of Nvidia graphics processing units, or GPUs, that can run generative AI models such as those enabling OpenAI’s ChatGPT chatbot. Those GPUs consume serious power, and soaring demand has created a bottleneck for standing up new facilities.

Microsoft’s investment comes on top of the capital expenditures needed to support infrastructure expansion for its Azure public cloud, which supplies OpenAI and other AI customers. Microsoft said in July that fiscal fourth-quarter capital spending, including assets acquired under finance leases, totaled $19 billion.

In January, BlackRock announced its intent to acquire GIP for $3 billion in cash and around 12 million shares of BlackRock common stock. BlackRock said last week that it expects the deal to close Oct. 1.

MGX was launched in March, with Abu Dhabi’s Mubadala and AI firm G42 as founding partners.

WATCH: AI drives big tech power demand

Source: https://www.cnbc.com

More Stories

Crypto’s $130 million congressional election binge has candidates like Utah’s John Curtis poised for big wins

Amazon makes first foray into live news with election night special hosted by Brian Williams

Google CEO names new search and ads boss, slides predecessor to role of chief technologist