Tesla, Nvidia lead tech-heavy Nasdaq to one of best days of 2024 after Fed rate cut

- The Federal Reserve’s interest rate cut sparked a rally in tech stocks.

- Tesla climbed 7.4% on Thursday, while Nvidia jumped 4% and rival chipmaker AMD rose 5.7%.

- The tech-heavy Nasdaq is now up 20% for the year.

Investors poured into tech stocks at one of the fastest clips of the year a day after the Federal Reserve cut its benchmark interest rate for the first time since 2020.

Led by a 7.4% gain in shares of Tesla and a 4% jump in Nvidia, the Nasdaq rose 2.5% on Thursday, its fourth-sharpest rally of 2024. The biggest gain of the year for the tech-heavy index was a 3% increase on Feb. 22.

Lower interest rates tend to benefit tech stocks because reduced borrowing costs and bond yields make risky bets more attractive. In addition to the central bank’s half-point reduction, the Federal Open Market Committee indicated through its “dot plot” the equivalent of 50 more basis points of cuts by the end of the year, eventually coming down by 2 percentage points beyond Wednesday’s move.

While the Nasdaq has been on a steady rise this year, powered by Nvidia and the enthusiasm around artificial intelligence, Thursday’s rally pushed the benchmark to its highest since mid-July. The Nasdaq peaked at 18,647.45 on July 10, and it is now just 3.5% shy of that level, closing at 18,013.98.

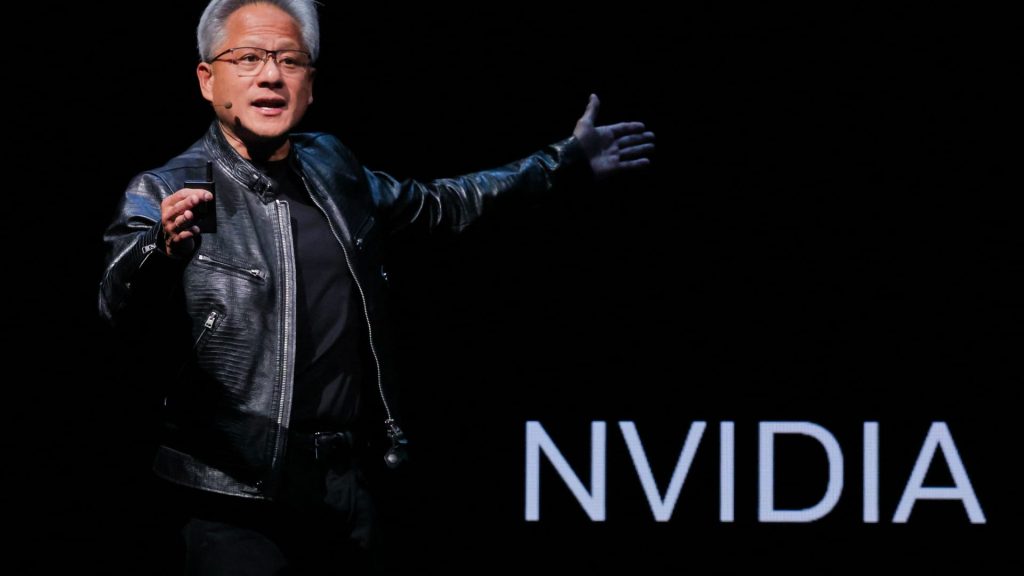

Nvidia, whose processors are powering the generative AI boom and services such as OpenAI’s ChatGPT, gained 4% on Thursday to $117.87. The shares are up about 138% for the year after more than tripling in 2023, though they are still 13% below their all-time high reached in June.

Nvidia counts on a relatively small group of customers — namely Microsoft, Meta, Alphabet, Amazon, Oracle and OpenAI — for an outsized amount of revenue because those are the companies either developing large language models, hosting big AI workloads or doing both. Any sign of slackening demand creates concern around Nvidia’s stock.

But lower rates are seen as another potential boon.

Fellow chipmakers Advanced Micro Devices and Broadcom also rallied big on Thursday, gaining 5.7% and 3.9%, respectively. AMD is trying to challenge Nvidia in the AI market, but it is far behind and has some skeptics on Wall Street. The stock is only up about 6% this year.

AMD CEO Lisa Su told CNBC’s Jim Cramer on Wednesday that AI is a very long game, and we are at the early stages.

“Let’s not be impatient. Tech trends are meant to play out over years, not over months,” Su said. “We’ve only been in this, let’s call it, ChatGPT world for maybe like 18 months. We’re all learning. It’s fun. We all use it.”

Su said AI is going to make its way into “all aspects of our lives,” including education and drug development.

“The beauty of all this is you need the computing, and that’s what we do,” Su said.

Tesla was the biggest gainer among tech’s megacap companies on Thursday, gaining 7.4%. The electric car maker has been a relative laggard for the year, down almost 2%, compared to the Nasdaq’s 20% gain. However, Tesla is up 72% from its low for the year in April.

Among the other top tech companies, Apple and Meta also closed with big gains, each rising almost 4%.

WATCH: Cramer’s interview with AMD CEO Lisa Su

Source: https://www.cnbc.com

More Stories

Crypto’s $130 million congressional election binge has candidates like Utah’s John Curtis poised for big wins

Amazon makes first foray into live news with election night special hosted by Brian Williams

Google CEO names new search and ads boss, slides predecessor to role of chief technologist